Applied statistics empowers businesses and economists to make data-driven decisions by analyzing trends‚ managing risks‚ and optimizing operations. It bridges statistical methods with real-world economic challenges‚ enabling informed decision-making and problem-solving in dynamic environments. By leveraging statistical tools‚ organizations can uncover insights‚ predict outcomes‚ and drive sustainable growth in both business and economic contexts.

1.1 Definition and Importance of Applied Statistics

Applied statistics involves the practical application of statistical methods to solve real-world problems in business and economics. It focuses on collecting‚ analyzing‚ and interpreting data to inform decision-making‚ identify trends‚ and forecast future outcomes. The importance of applied statistics lies in its ability to transform raw data into actionable insights‚ enabling businesses to optimize operations‚ manage risks‚ and improve profitability. In economics‚ it helps policymakers evaluate the impact of interventions and predict economic trends. By providing a data-driven approach‚ applied statistics bridges the gap between theory and practice‚ making it an indispensable tool for both industries. Its relevance spans market analysis‚ financial modeling‚ and policy evaluation‚ underlining its critical role in driving informed decision-making and fostering sustainable growth.

1.2 Role of Statistics in Business Decision-Making

Statistics plays a pivotal role in business decision-making by providing a data-driven framework for evaluating opportunities‚ assessing risks‚ and predicting outcomes. It enables organizations to identify trends‚ measure performance‚ and optimize resources. With statistical tools‚ businesses can analyze customer behavior‚ monitor market dynamics‚ and evaluate the effectiveness of strategies. This data-driven approach reduces uncertainty and enhances the accuracy of decisions. From forecasting sales to assessing financial risks‚ statistics empowers businesses to allocate resources efficiently and respond to market changes effectively. By leveraging statistical insights‚ companies can achieve competitive advantages‚ improve operational efficiency‚ and drive long-term success in an increasingly data-centric world.

1.3 Relevance of Statistical Methods in Economics

Statistical methods are essential in economics for analyzing data‚ understanding economic phenomena‚ and formulating policies. They enable economists to measure trends‚ test hypotheses‚ and predict future outcomes. From analyzing inflation rates to studying unemployment patterns‚ statistics provides tools to interpret complex economic data. Econometric models‚ built on statistical principles‚ help evaluate the impact of policy interventions. Regression analysis‚ hypothesis testing‚ and time-series analysis are widely used to study relationships between economic variables. These methods also aid in identifying patterns in trade‚ consumption‚ and investment. By applying statistical techniques‚ economists can provide evidence-based recommendations‚ fostering informed decision-making and sustainable economic development. Statistics thus forms the backbone of economic research and policy formulation.

Key Concepts and Tools in Applied Statistics

Descriptive statistics‚ probability distributions‚ hypothesis testing‚ and regression analysis are fundamental tools. They enable data analysis‚ interpretation‚ and informed decision-making in business and economics‚ using software like Excel‚ R‚ and Python.

2.1 Descriptive Statistics: Measures of Central Tendency and Variability

Descriptive statistics provide essential tools for summarizing and understanding data. Measures of central tendency‚ such as the mean‚ median‚ and mode‚ identify the central value of a dataset. Variability measures‚ like the range‚ variance‚ and standard deviation‚ quantify data dispersion. These concepts are vital for analyzing business and economic data‚ enabling organizations to assess market trends‚ consumer behavior‚ and financial risks. For instance‚ understanding the average income of a population helps in pricing strategies‚ while variability measures can highlight economic inequalities. These tools are extensively covered in textbooks like Applied Statistics for Business and Economics by Doane and Özdemir‚ which emphasize practical applications and real-world examples to illustrate their importance in decision-making processes.

2.2 Probability Distributions and Their Applications

Probability distributions are fundamental in applied statistics‚ enabling the modeling of random events and their potential outcomes. Common distributions include the normal distribution‚ binomial distribution‚ and Poisson distribution. These tools are crucial for understanding variability and uncertainty in business and economic data. For instance‚ the normal distribution is often used to model stock prices‚ while the binomial distribution helps in analyzing binary outcomes‚ such as product defects or customer churn. In economics‚ the Poisson distribution is applied to model events occurring over time‚ like the number of customers arriving at a store. These applications allow businesses and economists to forecast‚ manage risks‚ and make informed decisions. Textbooks like Doane’s and Özdemir’s provide detailed explanations and practical examples‚ reinforcing their relevance in real-world scenarios.

2.3 Hypothesis Testing and Confidence Intervals

Hypothesis testing and confidence intervals are essential tools in applied statistics for validating assumptions and estimating parameters. Hypothesis testing involves formulating null and alternative hypotheses to assess the significance of data patterns. It is widely used in business and economics to make informed decisions‚ such as testing market trends or evaluating policy impacts. Confidence intervals provide a range of plausible values for population parameters‚ offering a measure of uncertainty. For example‚ businesses use confidence intervals to estimate average consumer spending‚ while economists apply hypothesis testing to analyze the effectiveness of fiscal policies. Textbooks like Doane’s and Özdemir’s emphasize these methods‚ illustrating their practical applications in real-world scenarios to aid data-driven decision-making and research.

2.4 Correlation and Regression Analysis

Correlation and regression analysis are powerful tools for understanding relationships between variables in business and economics. Correlation measures the strength and direction of the relationship‚ while regression analysis models the relationship to predict outcomes. In business‚ regression is used to forecast sales based on advertising spend or to analyze customer preferences. Economists apply these methods to study the impact of policy changes on economic indicators. Tools like Excel and specialized software facilitate these analyses‚ enabling precise predictions and informed decision-making. These techniques are fundamental for uncovering patterns and making accurate forecasts‚ ensuring data-driven strategies in both fields. They are extensively covered in textbooks to highlight their practical relevance.

Data Collection and Analysis in Business and Economics

Data collection involves gathering primary and secondary sources to analyze trends‚ risks‚ and opportunities. It supports decision-making in business and economic strategies‚ using tools like Excel effectively.

3.1 Sources of Data: Primary vs. Secondary Data

Data collection in business and economics relies on two main sources: primary and secondary data. Primary data is collected directly from original sources‚ such as surveys‚ experiments‚ or interviews‚ tailored to specific research needs. Secondary data‚ in contrast‚ is obtained from existing sources like government reports‚ industry publications‚ or academic studies. Understanding the distinction is crucial for applying statistical methods effectively. Primary data offers unique insights but can be costly and time-consuming‚ while secondary data is more affordable and readily available but may lack specificity. Combining both sources often provides a comprehensive dataset for robust analysis.

3.2 Sampling Methods and Their Significance

Sampling methods are essential in applied statistics for efficiently collecting data while maintaining accuracy. Common techniques include random sampling‚ stratified sampling‚ cluster sampling‚ and convenience sampling. Random sampling ensures every population member has an equal chance of selection‚ minimizing bias. Stratified sampling divides the population into subgroups for more precise results. Cluster sampling targets specific segments to reduce costs. Convenience sampling‚ though less reliable‚ is quick and cost-effective. Each method balances accuracy‚ cost‚ and time‚ enabling researchers to draw meaningful inferences about larger populations. Proper sampling ensures data reliability‚ making it a cornerstone of robust statistical analysis in business and economic studies.

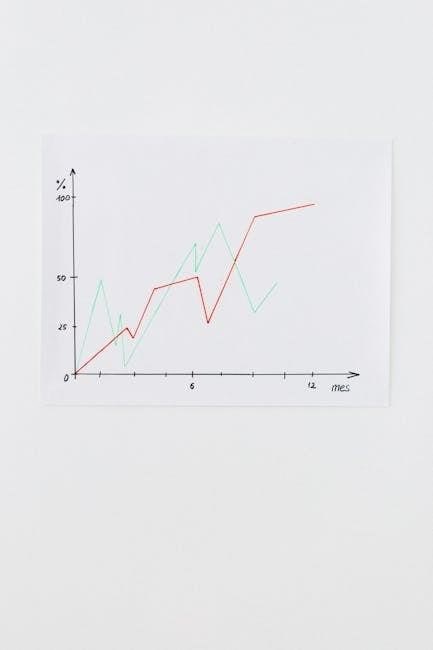

3.3 Data Visualization Techniques for Business Insights

Data visualization transforms complex data into actionable insights‚ enabling businesses to identify trends‚ patterns‚ and relationships. Common techniques include bar charts‚ line graphs‚ scatter plots‚ and heatmaps‚ each tailored to specific analytical needs. Tools like Excel‚ R‚ and Python facilitate the creation of interactive and dynamic visualizations. These tools help businesses communicate findings effectively‚ supporting decision-making processes. Advanced methods‚ such as dashboards and storytelling with data‚ enhance the ability to monitor performance and forecast future outcomes. By leveraging these techniques‚ organizations can unlock hidden insights‚ optimize operations‚ and drive strategic growth in competitive markets. Effective visualization ensures data-driven decisions are both informed and impactful.

Applications of Applied Statistics in Business

Applied statistics in business drives market analysis‚ financial risk assessment‚ operational efficiency‚ and human resource management‚ enabling data-driven decision-making across various industries.

4.1 Market Analysis and Consumer Behavior

Applied statistics plays a crucial role in market analysis and understanding consumer behavior by enabling businesses to identify trends‚ preferences‚ and purchasing patterns. Through statistical tools like regression analysis and clustering‚ companies can analyze customer data to predict demand‚ segment markets‚ and tailor products to specific demographics. These insights help in crafting targeted marketing strategies‚ improving customer satisfaction‚ and gaining a competitive edge. By leveraging statistical methods‚ businesses can make data-driven decisions to optimize their offerings and respond effectively to market dynamics‚ ensuring alignment with consumer needs and preferences in an ever-evolving economic landscape.

4.2 Financial Analysis and Risk Assessment

Applied statistics is essential in financial analysis and risk assessment‚ providing frameworks to evaluate investments‚ predict market trends‚ and mitigate uncertainties. Statistical models enable the analysis of financial data‚ such as stock prices and revenue streams‚ to assess portfolio performance and make informed investment decisions. Risk assessment techniques‚ including hypothesis testing and probability distributions‚ help identify potential threats and quantify their impact. By leveraging these tools‚ businesses can enhance financial planning‚ optimize resource allocation‚ and maintain stability in volatile markets. This ensures that financial strategies are grounded in data-driven insights‚ fostering resilience and long-term growth in both business and economic contexts. Effective use of statistical methods in finance is critical for navigating complexities and achieving sustainable success.

4.3 Operational Efficiency and Quality Control

Applied statistics play a pivotal role in enhancing operational efficiency and ensuring quality control within businesses. By analyzing data on production processes‚ companies can identify inefficiencies and optimize resource allocation to improve productivity. Statistical tools like Six Sigma and control charts are commonly used to monitor and enhance the quality of products and services‚ reducing variability and improving consistency. These methodologies enable businesses to set benchmarks‚ detect deviations‚ and implement corrective measures promptly. Ultimately‚ applied statistics contribute to cost savings‚ improved customer satisfaction‚ and a competitive edge in the market. This approach ensures that operational processes are both efficient and aligned with high-quality standards‚ driving overall business performance and sustainability.

4.4 Human Resource Management and Productivity

Applied statistics significantly enhances Human Resource Management and productivity by enabling data-driven decisions on employee performance‚ recruitment‚ and training. Statistical tools like regression analysis and correlation help identify factors influencing employee productivity and retention. By analyzing HR data‚ organizations can predict turnover‚ optimize workforce planning‚ and improve employee satisfaction. Additionally‚ statistical methods can evaluate the effectiveness of training programs and help in talent acquisition by identifying top candidates. These insights allow businesses to align HR strategies with organizational goals‚ fostering a more efficient and productive work environment. Furthermore‚ applied statistics supports diversity and inclusion initiatives by analyzing representation and engagement across different employee groups‚ aiding in benchmarking against industry standards.

Applications of Applied Statistics in Economics

Applied statistics in economics analyzes trends‚ forecasts outcomes‚ and informs policy decisions‚ helping to understand economic behaviors‚ inequalities‚ and international trade dynamics effectively.

5.1 Economic Forecasting and Policy Making

Economic forecasting and policy making rely heavily on applied statistics to predict future trends and inform decision-making. Statistical models analyze historical data to forecast GDP growth‚ inflation‚ and unemployment rates‚ enabling governments and organizations to develop proactive strategies. Techniques like regression analysis and time-series modeling are essential for identifying patterns and projecting economic outcomes. These forecasts guide fiscal and monetary policies‚ helping to stabilize economies and promote sustainable development. By leveraging statistical insights‚ policymakers can address potential challenges and opportunities effectively‚ ensuring data-driven decisions that foster economic prosperity and stability. Applied statistics thus play a vital role in shaping economic policies and guiding long-term planning.

5.2 Inequality and Poverty Analysis

Applied statistics play a crucial role in analyzing inequality and poverty by providing tools to measure and understand disparities in wealth and income distribution. Statistical measures such as the Gini coefficient and Lorenz curves are used to quantify inequality‚ while poverty rates are often assessed using thresholds like the poverty line. Data from household surveys and national accounts are analyzed to identify patterns and trends. These analyses inform policies aimed at reducing disparities‚ such as progressive taxation‚ social welfare programs‚ and targeted interventions. By applying statistical methods‚ researchers can evaluate the effectiveness of these policies and recommend data-driven solutions to address inequality and poverty‚ ultimately promoting more equitable societies and sustainable development.

5.3 International Trade and Economic Integration

Applied statistics are essential in analyzing international trade and economic integration‚ enabling researchers to understand trade patterns‚ tariff impacts‚ and market dynamics. Statistical tools help quantify the effects of trade agreements‚ such as changes in imports‚ exports‚ and GDP. Methods like gravity models and panel data analysis are used to study trade flows and regional integration. Additionally‚ statistical techniques assess the impact of economic policies on trade balances and foreign investment. These analyses support policymakers in designing evidence-based strategies to promote fair trade‚ reduce barriers‚ and foster economic cooperation. By leveraging statistical insights‚ countries can navigate global markets more effectively and achieve sustainable economic integration‚ driving mutual growth and prosperity.

Software and Tools for Applied Statistical Analysis

Popular tools like Excel‚ R‚ Python‚ SPSS‚ SAS‚ and Stata are widely used for statistical analysis‚ offering advanced features for data modeling‚ visualization‚ and interpretation. These tools enable businesses and economists to perform complex analyses efficiently‚ supporting decision-making and forecasting. They provide user-friendly interfaces‚ extensive libraries‚ and customization options‚ making them indispensable for applied statistics in various fields.

6.1 Microsoft Excel for Business Statistics

Microsoft Excel is a widely used tool for applied statistics in business‚ offering user-friendly features for data analysis and visualization. It supports statistical functions like regression‚ correlation‚ and hypothesis testing through add-ins such as the Data Analysis ToolPak. Excel’s pivot tables and charting capabilities make it ideal for summarizing and presenting data insights. Its integration with R and Python enhances advanced analytics. Businesses leverage Excel for financial analysis‚ forecasting‚ and operational efficiency‚ making it a cornerstone for statistical applications in both academic and professional settings. Its accessibility and versatility ensure its continued relevance in business statistics.

- Key features: statistical functions‚ data visualization‚ and add-ins.

- Applications: financial analysis‚ forecasting‚ and operational efficiency.

6.2 R and Python Programming for Advanced Analytics

R and Python are powerful programming languages widely adopted for advanced statistical analysis in business and economics. R excels in data visualization and complex modeling‚ with libraries like dplyr and ggplot2‚ while Python’s Pandas‚ NumPy‚ and Scikit-learn enable efficient data manipulation and machine learning. Both languages support hypothesis testing‚ regression analysis‚ and predictive modeling‚ making them indispensable for big data applications. Their versatility allows integration with tools like Excel and SQL‚ enhancing workflow efficiency. These languages are essential for professionals seeking to apply advanced statistical methods in dynamic business and economic environments‚ providing robust solutions for data-driven decision-making and innovation.

- Key features: advanced modeling‚ data manipulation‚ and machine learning.

- Applications: predictive analytics‚ big data analysis‚ and business insights.

6.3 Specialized Software: SPSS‚ SAS‚ and Stata

SPSS‚ SAS‚ and Stata are specialized software tools widely used for advanced statistical analysis in business and economics. SPSS is renowned for its user-friendly interface and robust capabilities in survey research and predictive analytics. SAS excels in handling large datasets and complex statistical modeling‚ making it a favorite in corporate and academic settings. Stata‚ on the other hand‚ is a powerful tool for econometric analysis‚ offering advanced features for time-series analysis and panel data modeling. These software solutions provide extensive libraries for data visualization‚ hypothesis testing‚ and machine learning‚ enabling professionals to perform sophisticated data analysis efficiently. Their versatility and reliability make them indispensable for researchers and analysts seeking precise insights in dynamic business and economic environments.

- Key features: advanced modeling‚ data visualization‚ and predictive analytics.

- Applications: survey research‚ econometrics‚ and complex data analysis.

Real-World Case Studies and Examples

Applied statistics transforms business and economic challenges into actionable insights. Retailers optimize inventory using sales data‚ banks assess credit risks‚ and healthcare analyzes cost efficiencies‚ demonstrating real-world impact.

7.1 Statistical Analysis in Retail and E-Commerce

In retail and e-commerce‚ applied statistics plays a pivotal role in driving business success. By analyzing customer purchasing patterns‚ businesses can optimize inventory management to minimize stockouts and overstocking. Statistical tools like regression analysis help predict sales trends‚ enabling companies to adjust pricing strategies dynamically. Additionally‚ clustering algorithms segment customers based on behavior‚ allowing for personalized marketing campaigns. A/B testing is widely used to determine the effectiveness of different product layouts or promotions. Moreover‚ statistical models assess the impact of seasonal factors on demand‚ ensuring businesses are prepared for fluctuations. These applications not only enhance operational efficiency but also improve customer satisfaction‚ leading to increased loyalty and revenue growth in the competitive retail landscape.

7.2 Applied Statistics in Banking and Finance

In the banking and finance sector‚ applied statistics is instrumental in managing risks‚ optimizing portfolios‚ and ensuring regulatory compliance. Statistical models analyze creditworthiness to assess loan eligibility and predict default probabilities; Portfolio management leverages statistical techniques to diversify investments and maximize returns while minimizing risks. Fraud detection systems utilize statistical algorithms to identify unusual transaction patterns‚ enhancing security. Additionally‚ statistical forecasting aids in predicting interest rates and market trends‚ informing strategic decisions. Algorithmic trading relies on statistical models for high-speed‚ data-driven transactions. Compliance requirements also demand statistical analysis to monitor financial health and adherence to regulations. These applications ensure banks and financial institutions operate efficiently‚ securely‚ and competitively in a data-driven economy.

7.3 Statistical Methods in Healthcare Economics

Statistical methods play a pivotal role in healthcare economics‚ enabling researchers and policymakers to analyze costs‚ outcomes‚ and resource allocation. Techniques such as regression analysis and econometric modeling help quantify the impact of treatments‚ policies‚ and demographic factors on healthcare expenses. Statistical tools are used to assess the effectiveness of medical interventions‚ measure health disparities‚ and forecast disease prevalence. Machine learning algorithms are increasingly applied to predict patient outcomes and optimize resource utilization. By applying statistical methods‚ healthcare economists can identify cost-saving measures‚ evaluate policy interventions‚ and improve the overall efficiency of healthcare systems. These insights are crucial for designing equitable and sustainable healthcare solutions in an ever-evolving industry.

Future Trends in Applied Statistics

The integration of big data‚ artificial intelligence‚ and machine learning is revolutionizing applied statistics. Predictive analytics and real-time decision-making are becoming central‚ alongside a growing emphasis on ethics and data privacy.

8.1 Big Data and Machine Learning Integration

The integration of big data and machine learning into applied statistics is transforming business and economic analysis. Big data provides vast‚ complex datasets‚ enabling deeper insights through advanced statistical methods. Machine learning algorithms‚ such as predictive modeling and clustering‚ enhance the ability to identify patterns and forecast trends. This synergy allows businesses to make data-driven decisions in real-time‚ optimizing operations and strategy. In economics‚ these tools enable researchers to analyze large-scale phenomena‚ such as market dynamics and policy impacts‚ with greater precision. The combination of big data and machine learning is driving innovation‚ making statistical analysis more efficient and impactful across industries. This trend is reshaping how businesses and economists approach problem-solving and decision-making in an increasingly data-centric world.

8.2 Artificial Intelligence in Statistical Modeling

Artificial intelligence (AI) is revolutionizing statistical modeling by automating complex analyses and enhancing predictive capabilities. Machine learning algorithms‚ a subset of AI‚ enable businesses and economists to uncover hidden patterns in large datasets. AI-driven tools optimize forecasting‚ improve decision-making‚ and streamline data interpretation. In business‚ AI facilitates real-time market trend analysis and customer behavior prediction. In economics‚ it aids in modeling macroeconomic scenarios and policy impacts. However‚ challenges like data privacy and algorithmic bias must be addressed. As AI evolves‚ its integration with applied statistics will further empower organizations to make smarter‚ data-driven decisions‚ driving innovation and efficiency across industries. The future of statistical modeling lies in this synergy between AI and traditional methods.

8.3 Ethics and Data Privacy in Statistical Analysis

Ethical considerations and data privacy are critical in applied statistics‚ ensuring responsible use of data. With increasing data collection‚ protecting sensitive information is paramount to prevent misuse and maintain trust. Statistical analysis must adhere to ethical guidelines‚ avoiding biases and ensuring transparency in methods. Privacy laws like GDPR regulate data handling‚ emphasizing consent and accountability. Ethical practices promote fairness in decision-making and protect individuals from potential harm. As data-driven insights grow‚ balancing innovation with ethical standards is essential to uphold integrity in business and economic applications. Organizations must prioritize data security and ethical practices to foster trust and accountability in statistical analysis. This ensures that statistical methods serve societal good while respecting individual rights. Ethical data practices are non-negotiable in modern statistical applications.